Full text loading...

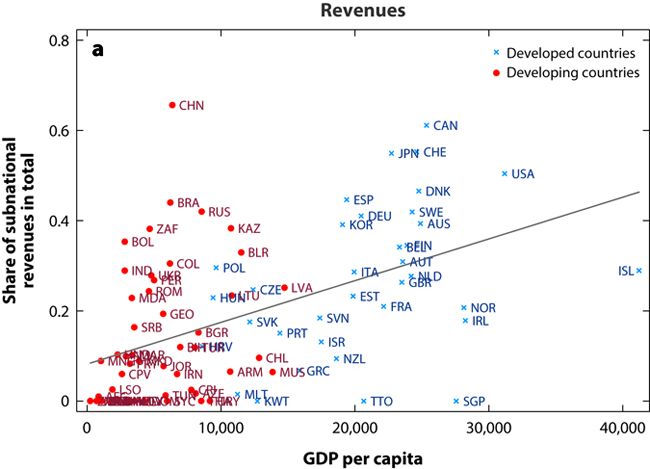

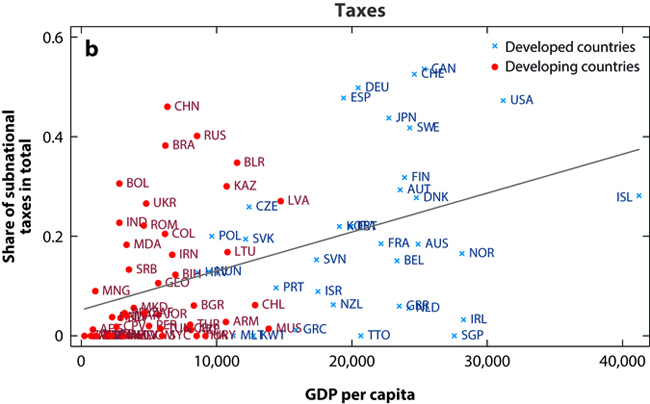

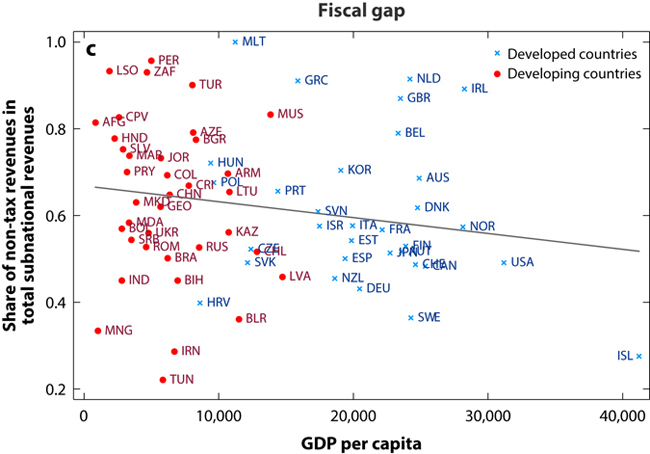

Standard models of fiscal federalism suggest many benefits of decentralization in developing economies, and there has been a recent push toward decentralization around the world. However, developing countries presently still have less decentralization, particularly on the revenue side, than both developed countries today and the United States and Europe historically. We consider how the trade-offs associated with fiscal federalism apply in developing countries and discuss reasons for their relatively low levels of decentralization. We also consider additional features relevant to federalism in developing economies, such as the prevalence of nongovernmental organizations and the role of social incentives in policy design.

Article metrics loading...

Full text loading...

Literature Cited

Data & Media loading...

Supplemental Material

Download Supplemental Figures 1a-c as a single PDF, or see below.